Introduction

India’s innovation ecosystem is evolving beyond traditional tech hubs like Bengaluru and Hyderabad. With strategic government backing, a wave of emerging tech zones is rising across India targeting fields such as semiconductors, AI, clean tech, biotech, EVs and deeptech R&D.

These zones are purpose-built to offer foreign tech companies, startups and R&D units a seamless platform for India market entry, joint innovation and cross-border academic collaboration.

At the International Advisory Council (IAC), we work closely with these clusters to help international companies identify innovation-ready locations aligned with both policy incentives and business goals.

What Are Emerging Tech Zones?

These are government-recognized innovation corridors, parks and R&D clusters, often tied to:

- State industrial policies

- Production-linked incentive (PLI) schemes

- Central R&D and digital infrastructure missions

- Institutional partnerships with universities and academic partnerships India

They offer:

- Special incentives for R&D, IP development and prototyping

- Access to skilled talent and local research networks

- In-country representation India for real-time coordination and scale

Key Tech Zones You Should Know

1. Dholera Special Investment Region (Gujarat)

- Focus: Semiconductors, electronics, smart mobility

- Location for India’s first chip fabrication units under ISM scheme

- Incentives: CAPEX subsidies, electricity waivers, high-speed connectivity

2. Yadadri-Bhuvanagiri (Telangana)

- Home to India’s pharma and medtech park

- Linked with Hyderabad’s deep biotech ecosystem

- Offers shared testing labs, plug-and-play pharma zones and B2B matchmaking India

3. Tamil Nadu EV Cluster

- Cities like Coimbatore and Hosur emerging as EV and battery tech hotspots

- Foreign OEMs entering via joint ventures and tech partnerships

- Linked with global supply chains and India’s green industrial policy

4. Karnataka Beyond Bengaluru

- Emerging AI, drone and deeptech zones in Mysuru and Hubballi

- Strong university network for joint degree programs India

- State co-funds R&D for high-risk, high-reward startups

Opportunities for Global Innovators

Foreign tech firms can:

- Establish pilot R&D centers with subsidized infrastructure

- Tap into co-funded grants via state or central innovation missions

- Build academic partnerships India for talent development and tech transfer

- Localize offerings via India higher education consulting networks

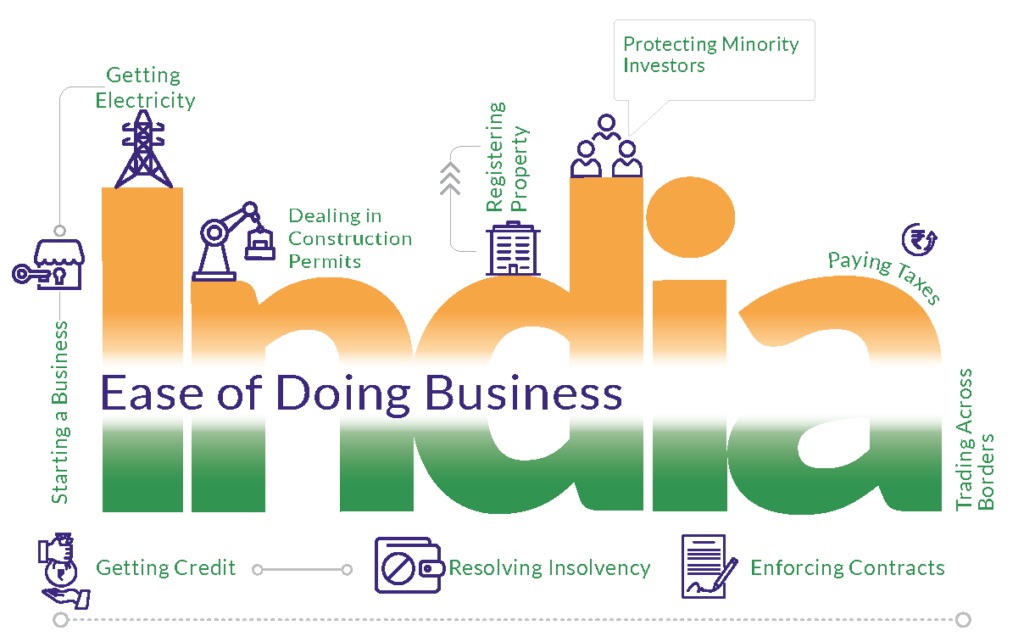

- Leverage India investment facilitation for fast-track approvals

These zones are designed for first movers, who benefit most from early partnerships and media visibility.

Case Study: Nordic Clean Tech Startup in Coimbatore

A Scandinavian clean-tech company approached IAC to assess India’s EV battery market. With our guidance, they:

- Partnered with a local manufacturer in Tamil Nadu’s EV cluster

- Set up an R&D hub with state-funded prototyping support

- Engaged in education roadshows India to recruit local engineers

- Secured ESG-aligned investments via India’s green tech platform

Outcome: A low-risk, high-visibility expansion into a booming sector.

IAC’s Role in Tech Zone Entry

We help:

- Identify the best-fit tech zones by industry focus

- Connect with state-level innovation councils and IPAs

- Structure joint innovation models and funding access

- Establish in-country representation India to fast-track execution

- Align your branding with PR for international companies in India

We also support EDBs and investment promotion agencies in positioning their regions as tech partners for India.

Sectors Gaining Traction

- Semiconductors and electronics

- AI, robotics and automation

- Battery storage and green hydrogen

- Pharmaceuticals and medtech

- Agri-tech and food innovation

Conclusion

India’s tech zones are not just local growth stories they are gateways to global collaboration. For foreign innovators, these zones offer talent, funding, policy alignment and access to one of the world’s fastest-growing tech markets.

With IAC as your partner, you can enter the Indian innovation ecosystem with clarity, credibility and competitive advantage.

India’s Emerging Tech Zones: Why Foreign Innovators Should Take Note

Introduction

India’s innovation ecosystem is evolving beyond traditional tech hubs like Bengaluru and Hyderabad. With strategic government backing, a wave of emerging tech zones is rising across India targeting fields such as semiconductors, AI, clean tech, biotech, EVs and deeptech R&D.

These zones are purpose-built to offer foreign tech companies, startups and R&D units a seamless platform for India market entry, joint innovation and cross-border academic collaboration.

At the International Advisory Council (IAC), we work closely with these clusters to help international companies identify innovation-ready locations aligned with both policy incentives and business goals.

What Are Emerging Tech Zones?

These are government-recognized innovation corridors, parks and R&D clusters, often tied to:

- State industrial policies

- Production-linked incentive (PLI) schemes

- Central R&D and digital infrastructure missions

- Institutional partnerships with universities and academic partnerships India

They offer:

- Special incentives for R&D, IP development and prototyping

- Access to skilled talent and local research networks

- In-country representation India for real-time coordination and scale

Key Tech Zones You Should Know

1. Dholera Special Investment Region (Gujarat)

- Focus: Semiconductors, electronics, smart mobility

- Location for India’s first chip fabrication units under ISM scheme

- Incentives: CAPEX subsidies, electricity waivers, high-speed connectivity

2. Yadadri-Bhuvanagiri (Telangana)

- Home to India’s pharma and medtech park

- Linked with Hyderabad’s deep biotech ecosystem

- Offers shared testing labs, plug-and-play pharma zones and B2B matchmaking India

3. Tamil Nadu EV Cluster

- Cities like Coimbatore and Hosur emerging as EV and battery tech hotspots

- Foreign OEMs entering via joint ventures and tech partnerships

- Linked with global supply chains and India’s green industrial policy

4. Karnataka Beyond Bengaluru

- Emerging AI, drone and deeptech zones in Mysuru and Hubballi

- Strong university network for joint degree programs India

- State co-funds R&D for high-risk, high-reward startups

Opportunities for Global Innovators

Foreign tech firms can:

- Establish pilot R&D centers with subsidized infrastructure

- Tap into co-funded grants via state or central innovation missions

- Build academic partnerships India for talent development and tech transfer

- Localize offerings via India higher education consulting networks

- Leverage India investment facilitation for fast-track approvals

These zones are designed for first movers, who benefit most from early partnerships and media visibility.

Case Study: Nordic Clean Tech Startup in Coimbatore

A Scandinavian clean-tech company approached IAC to assess India’s EV battery market. With our guidance, they:

- Partnered with a local manufacturer in Tamil Nadu’s EV cluster

- Set up an R&D hub with state-funded prototyping support

- Engaged in education roadshows India to recruit local engineers

- Secured ESG-aligned investments via India’s green tech platform

Outcome: A low-risk, high-visibility expansion into a booming sector.

IAC’s Role in Tech Zone Entry

We help:

- Identify the best-fit tech zones by industry focus

- Connect with state-level innovation councils and IPAs

- Structure joint innovation models and funding access

- Establish in-country representation India to fast-track execution

- Align your branding with PR for international companies in India

We also support EDBs and investment promotion agencies in positioning their regions as tech partners for India.

Sectors Gaining Traction

- Semiconductors and electronics

- AI, robotics and automation

- Battery storage and green hydrogen

- Pharmaceuticals and medtech

- Agri-tech and food innovation

Conclusion

India’s tech zones are not just local growth stories they are gateways to global collaboration. For foreign innovators, these zones offer talent, funding, policy alignment and access to one of the world’s fastest-growing tech markets.

With IAC as your partner, you can enter the Indian innovation ecosystem with clarity, credibility and competitive advantage.